AARP Tax Aide Tips: How Long Should I keep Tax Records?

SPONSORED CONTENT

SPONSORED CONTENT

By Jim Young

Ask ten economists the same question and the range of answers you get will be surprising. This also holds true when you ask Enrolled Agents, CPAs, the IRS, or Financial Planners how long to retain tax documents. The range of responses will run from a minimum period of time to a lifetime.

The official answer to tax document retention is provided in the nine pages of Publication 552 prepared by the IRS. Page 6, Table 3 directly addresses “How Long to Keep Records.” Go to irs.gov and search for Pub 552.

The IRS publication says that you are required to keep records as long as they may be needed for the administration of any provision of the Internal Revenue Code. You should construe this to mean you should keep records that support items on your tax return until the period of limitations for that return runs out.

The IRS publication says that you are required to keep records as long as they may be needed for the administration of any provision of the Internal Revenue Code. You should construe this to mean you should keep records that support items on your tax return until the period of limitations for that return runs out.

The period of limitations is defined by the IRS as the period of time in which you can amend your return to claim a credit or refund or the IRS can assess additional tax.

1. Owe additional tax and (2), (3) and (4) do not apply to you – 3 years

2. Do not report income that you should and it is more than 25% of the gross income shown on your return – 6 years

3. File a fraudulent return – No limit

4. Do not file a return – No limit

5. File a claim for credit or refund after you filed a return – The later of 3 years or 2 years after tax was paid

6. File a claim for a loss from worthless securities – 7 years

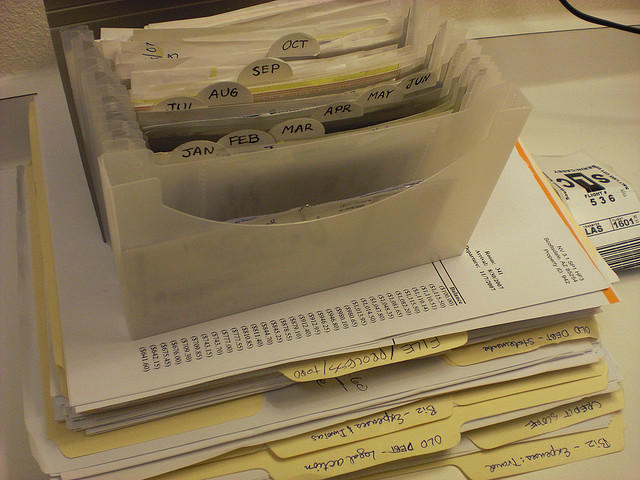

Unless you have a horribly complicated return each year, the space required to store that return and supporting documents is minimal. You can probably retain twenty years of returns in one of the inexpensive snap-top plastic containers available, and store it in a closet, attic, or basement in the event the IRS comes calling.

[Photo by i am real estate photographer]